Over 70 percent of Philippines remains unbanked, according to the Bangko Sentral ng Pilipinas (BSP). Compare that with studies that show nearly the same number of Filipinos (69 percent) use a mobile phone and you can understand why many banks and financial institutions see this as both a challenge and an opportunity. Many of these institutions have offered products and services in recent years designed to get more Filipinos involved in more formal financial platforms and channels.

The latest to offer such service is multinational bank ING, which launched its mobile-first and all-digital retail platform earlier this week. Although it has had a presence in the country since 1990, the ING savings account is its entry product specifically targeted towards “digital-ready” Filipinos.

ADVERTISEMENT – CONTINUE READING BELOW

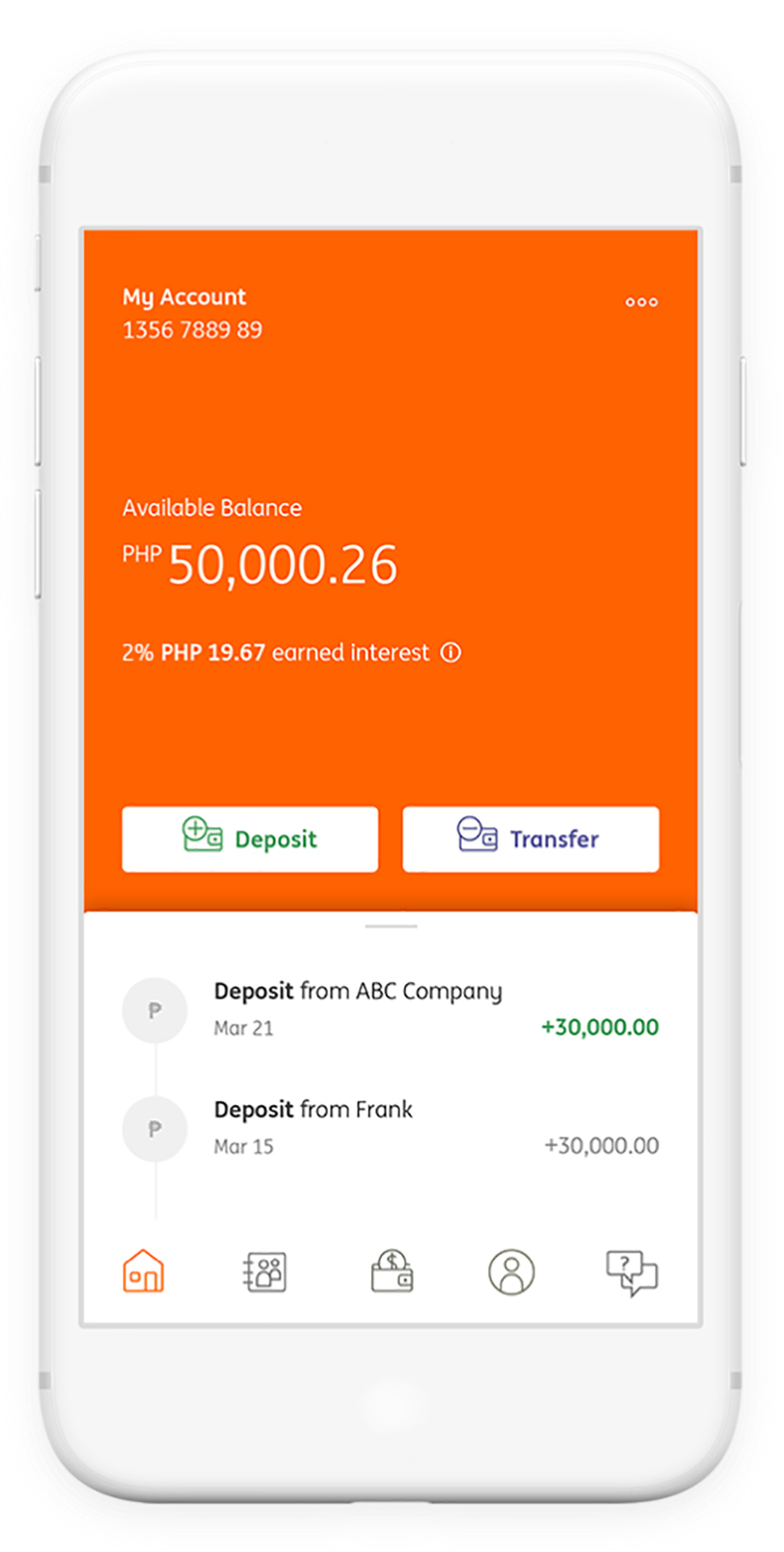

“The Philippines is on the road to become an upper middle income economy and Filipinos have more disposable income,” said Hans Sicat, ING Philippines’ country manager. “ING wants to encourage more Filipinos to save by giving an attractive interest rate of 2.5 percent per annum (for balance up to P10 million) and no lock-in period. We want to help promote a healthy savings mindset, and with our high interest rate, to help Filipinos achieve their savings goals faster.”

Besides the competitive 2.5 percent interest rate (which will take effect on June 1, 2019), ING hopes to attract customers with its unique and completely mobile experience—no need to go to a brick-and-mortar bank branch to submit the usual documents needed to open the account. ING says it is the first bank authprized by the BSP to allow end-to-end electronic onboarding of the customers via mobile phones by using the latest in facial recognition technology. And depositing is as easy as transferring funds from other banks that are on the PESONet or Instapay platforms.

ADVERTISEMENT – CONTINUE READING BELOW

One gamechanging feature of the ING savings account is how customers can deposit checks to their accounts by taking a picture of the check and uploading it directly into the app.

“The check image goes to the same interbank check clearing system,” said Mohamed Keraine, ING Philippines’ Head of Retail. “This feature is the first-ever approved by the Philippine Clearing House Corporation.”Â

ADVERTISEMENT – CONTINUE READING BELOW

Customers can transfer the money to another account with an ATM to be able to withdraw their funds.

As for questions on security, officials made the assurance that the app has the full backing of its global footprint and experience in branchless banking for over 20 years.

ADVERTISEMENT – CONTINUE READING BELOW

“We are able to use the latest security features in accordance with ING’s global standards,” said Ben Issa, ING’s chief information officer for retail banking in Asia. “This allowed the team to focus on making the local digital platform resilient, secure and reliable without compromisng the customer experience.”

For its part, the BSP, through its deputy governor Chuchi Fonacier, said it welcomed this new product from ING.

“We support ING’s use of groundbreaking technology that will enhance customer experience and encourage their shift into more cashless transactions,” Fonacier said. “ING is one of the first few banks to adopt PESONet, and now they are also connected to the InstaPay platform. Both are initiatives by the BSP to promote digital fund transfers. We are happy to work with ING to move a step closer to our goal of increasing cashless transactions in the Philippines.”

The ING app is avaialble for download on Apple’s App Store and Google Play. ing.com.ph

ADVERTISEMENT – CONTINUE READING BELOW

*****

This story originally appeared on Esquiremag.ph.

* Minor edits have been made by the Entrepreneur.com.ph editors.

Source link

DRIVE STARTUPS We Present Latest Startup News, Tips & Inspiration

DRIVE STARTUPS We Present Latest Startup News, Tips & Inspiration