[ad_1]

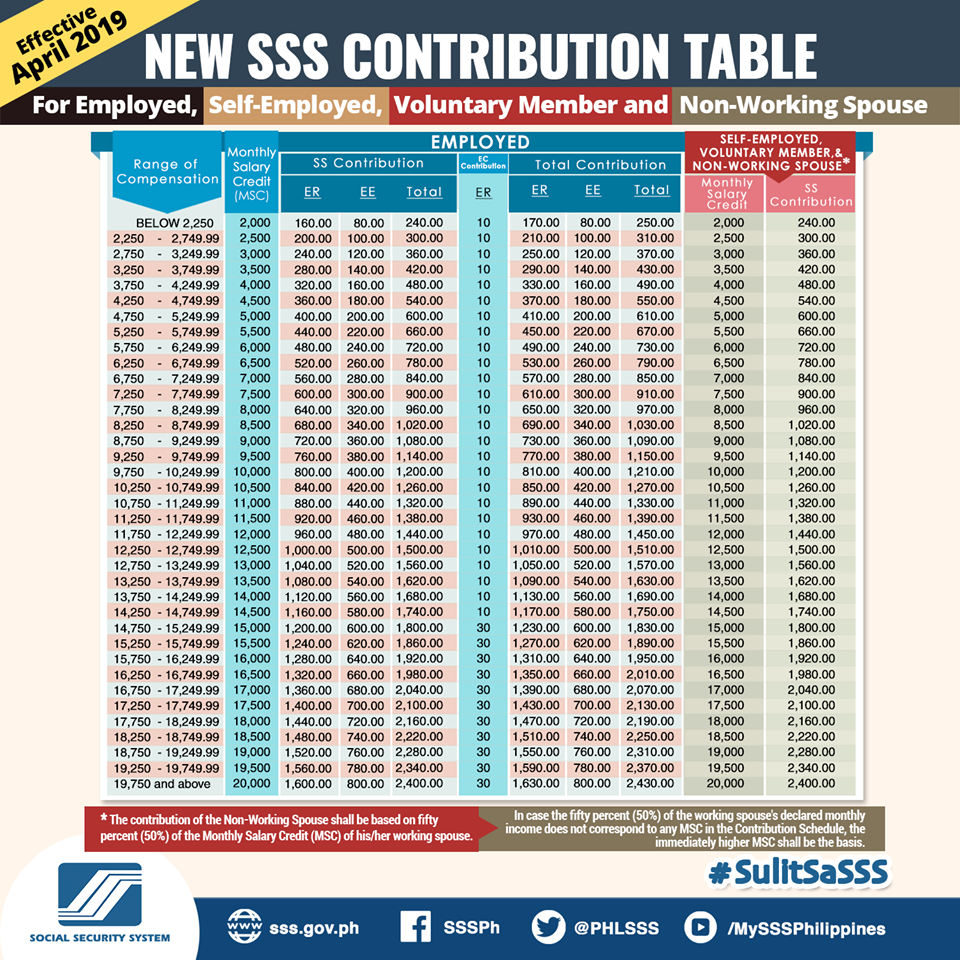

The first wave of the increase in Social Security System (SSS) monthly contributions will begin this month, April 2019. From 11 percent, SSS contributions will now amount to 12 percent of the individual’s salary with the employers shelling out more than the employees (scroll down below how this affects your salary deductions for SSS). The agency plans to increase monthly contributions to 15 percent by the year 2025 to make sure SSS is funded until 2045.

SSS justified this year’s one-percent increase in premium payments by saying it will help its members save more for retirement. The agency also adjusted the minimum and maximum monthly salary credits. (Monthly salary credit or MSC means the compensation base for contributions and benefits related to your total earnings for the month.) The maximum covered earnings or compensation was previously Php16,000, which has now been set at Php20,000 (the minimum is Php2,000 from Php1,000).

Newly-appointed SSS chair Aurora Cruz Ignacio told CNN Philippines that the increase will allow members to apply for a higher amount of benefits and loan privileges.

ADVERTISEMENT – CONTINUE READING BELOW

An employee earning Php20,000 a month will now enjoy a Php600 sickness benefit — that’s Php120 more based on the previously allowed sickness benefit of Php480 when the employee’s MSC was just at Php 16,000. The employee’s monthly basic pension when he retires also increases from Php6,400 to Php8,000.

New benefits such as pension hikes, unemployment insurance, and expanded maternity leave benefits are all set to be implemented by the SSS.

The increase in contributions was announced at the start of the 2019. On April 1, the agency shared an infographic of the breakdown for the new SSS contributions on their social media pages.

ADVERTISEMENT – CONTINUE READING BELOW

What you need to know to read the new SSS contribution table

– Range of compensation is an employee’s basic salary or a kasambahay’s basic salary.

– MSC is the total SSS contribution shared by employees and employers. When you apply for a loan or a benefit, SSS uses this bracket to determine how much you are entitled to.

– SS Contribution-ER is the employer’s share in the total Social Security (SS) Contribution.

– SS Contribution-EE is the employee’s share in the total Social Security (SS) Contribution.

– EC Contribution amounts to Php10 and is solely paid for by the employer. EC stands for Employee’s Compensation Progam, which is a fund for work-connected injury, sickness, disability and death with cash income benefit, medical, rehabilitation and related services.

How much will employers and employees contribute

The actual total additional amount for SSS contributions will depend on your base salary. Employers will shoulder 8% of the 12% monthly contribution while the remaining 4% will be deducted from the employee’s salary.

Based on the one-percent SSS contribution increase, if an employee is earning Php10,000 a month, his salary deduction for his SSS benefits will now be Php400 instead of the previous rate of Php363.30. For the employer’s share, it’s now required to pay Php800, instead of the previous rate of Php736.70. The employer will also pay Php10 for the EC program.

ADVERTISEMENT – CONTINUE READING BELOW

PHOTO BY Screenshot from Facebook.com/SSSph

A non-working spouse’s MSC is equal to half of her spouse’s MSC. If a working spouse has an MSC of Php20,000, then the non-working spouse’s MSC is Php10,000. A non-working spouse and a self-employed individual will pay in full for their SSS contribution.

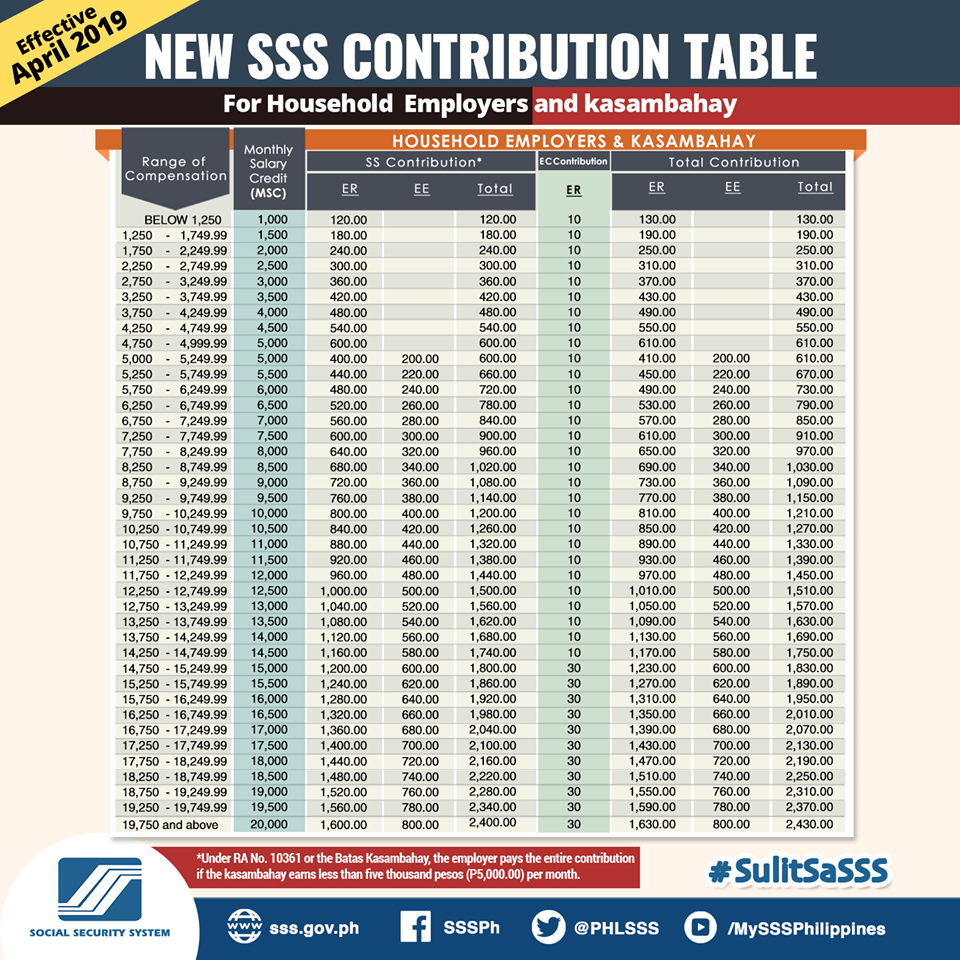

Household employers will pay more for the SSS benefits of their kasambahay

Under Republic Act No. 10361, or more popularly known as Batas Kasambahay Law or Domestic Workers Act on 2013, the household employer is required to pay her employee’s SSS contribution in full if the kasambahay earns a salary below Php5,000.

If your helper’s basic salary is Php 4,500 , you need to shoulder her SSS premium in full, which is Php540. If your helper’s salary is Php8,000, you will pay SSS Php650 while the kasambahay will shoulder Php320. As the employer, you will have to pay the Php10 allotted for the EC program.

ADVERTISEMENT – CONTINUE READING BELOW

PHOTO BY screenshot from Facebook.com/SSSph

PHOTO BY screenshot from Facebook.com/SSSph

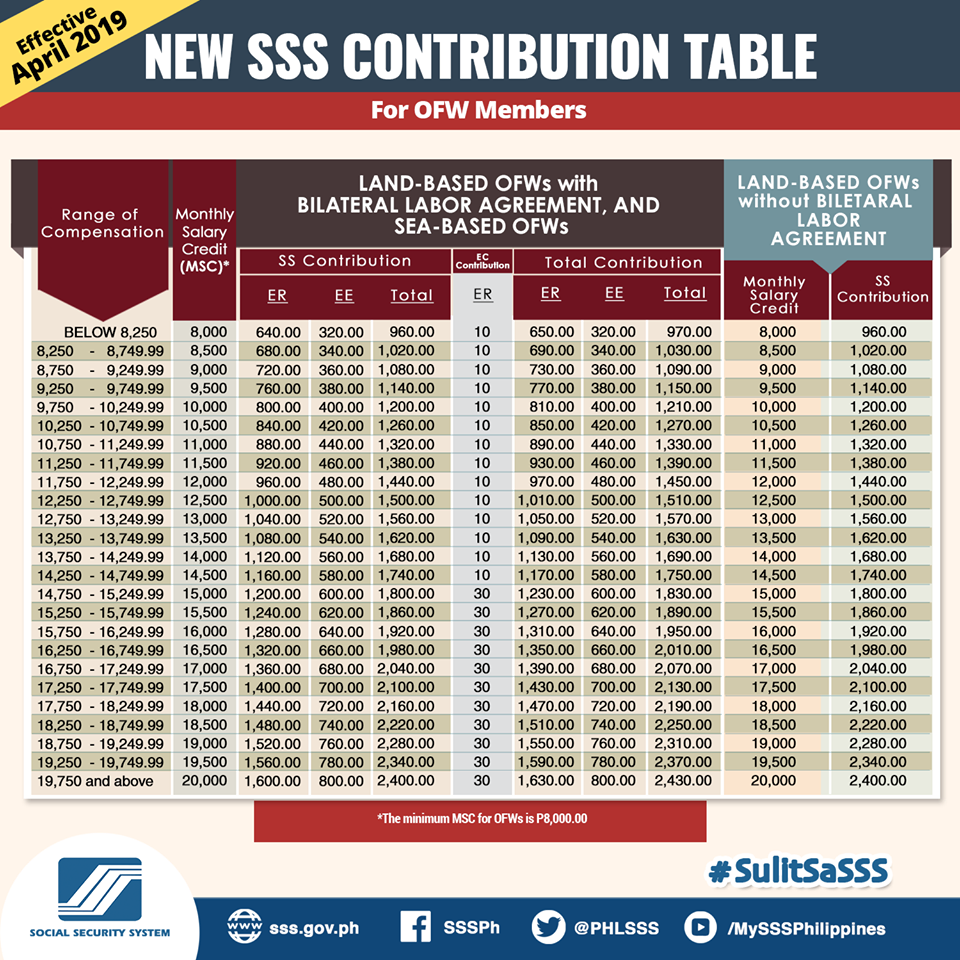

OFWs now have higher minimum Monthly Salary Credit

An OFW’s minimum MSC, on the other hand, is now at a minimum of Php8,000 from the previous Php5,000. OFWs will pay for only a fraction of their total SSS contribution because their employers will shoulder the remaining amount, plus the Php10 EC contribution.

ADVERTISEMENT – CONTINUE READING BELOW

PHOTO BY screenshot from Facebook.com/SSSph

Download the complete 2019 New SSS Contribution Payments here.

*****

This story originally appeared on Smartparenting.com.ph.

* Minor edits have been made by the Entrepreneur.com.ph editors.

Source link

DRIVE STARTUPS We Present Latest Startup News, Tips & Inspiration

DRIVE STARTUPS We Present Latest Startup News, Tips & Inspiration