[ad_1]

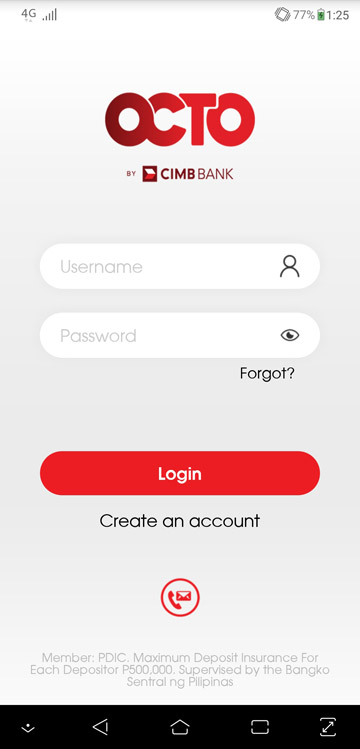

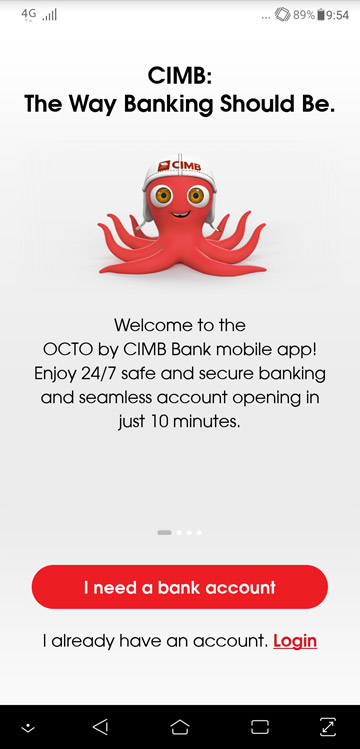

If you’re working the usual nine-to-five shift, it may be difficult to find time to sprint out to accomplish your banking errands—because really, you wouldn’t want to wait in line when you’ve got projects to finish by the end of the day. This makes mobile banking much more enticing since it allows you to simply do your transactions through your smartphone. Now, a new bank in the country takes it a step further—CIMB (Commerce International Merchant Bankers), which touts itself as “the nation’s first all-digital and mobile-first” bank, has recently launched with its fully-functional mobile app called OCTO.

Through OCTO, you can create a CIMB savings account without going through the hassle of running to your nearest bank. There are two options you can choose:

ADVERTISEMENT – CONTINUE READING BELOW

Fast Account

If you want an account you can use for your online purchases, remittances, and fund transfers that you know that you won’t really be depositing your life savings into, then Fast Account is the option for you. Valid for only 12 months, it’s great for short-term use, and even comes with a complimentary VISA debit card which you can use to withdraw from any ATM in the country. There’s no initial deposit required, and application only takes 10 minutes through your mobile phone.

UpSave Account

A more long-term banking solution is CIMB’s UpSave account, which you can still apply for through your phone but will take a little longer to process, as it requires a digital signature and a video KYC (Know Your Customer) verification. The small effort is well worth it, though, as it offers a 2.00 % interest rate per year, which is eight times higher than your regular bank.

The UpSave Account is best if you want to keep yourself from easily withdrawing your savings as it does not offer a debit card, but supports fund transfers, bill payments, and deposits.

ADVERTISEMENT – CONTINUE READING BELOW

You can deposit your money to your chosen CIMB service through any of the bank’s partners, including 7-Eleven and Dragon Pay in Robinsons Malls, SM Malls, LBC, M. Lhuillier, Cebuana Lhuillier, and other local banks.

“Consumers of today and tomorrow need innovative financial solutions that are relevant to their needs…but they don’t necessarily need a physical bank,” says CIMB Philippines CEO Vijay Manoharan in a release. “By offering most of our products via the OCTO app securely, we are offering next-level any day, any time convenience for our customers by enabling them to effectively ‘carry’ our bank branch in the palm of your hands.”

CIMB Philippines’ OCTO app is available for Apple and Android devices. For more details on their financial offerings, visit their Facebook page.

*****

This story originally appeared on FemaleNetwork.com.

* Minor edits have been made by the Entrepreneur.com.ph editors.

Source link

DRIVE STARTUPS We Present Latest Startup News, Tips & Inspiration

DRIVE STARTUPS We Present Latest Startup News, Tips & Inspiration