[ad_1]

Many people who are employed may not notice the meager amount deducted from their monthly salaries that go to their Home Development Mutual Fund (Pag-IBIG) accounts. After all, what’s a few hundred pesos?

But cumulatively, and most especially when checked years after the 9-to-5 routine, one might be surprised to see how much those few hundreds of pesos can grow. It may not be enough to buy a house, but it’s still a sizeable sum that could have been otherwise spent on stuff that may no longer spark joy.

ADVERTISEMENT – CONTINUE READING BELOW

Unknown to most though, that mandatory monthly contribution to your Pag-IBIG account isn’t the only savings plan offered by the government-run savings and mortgage fund.

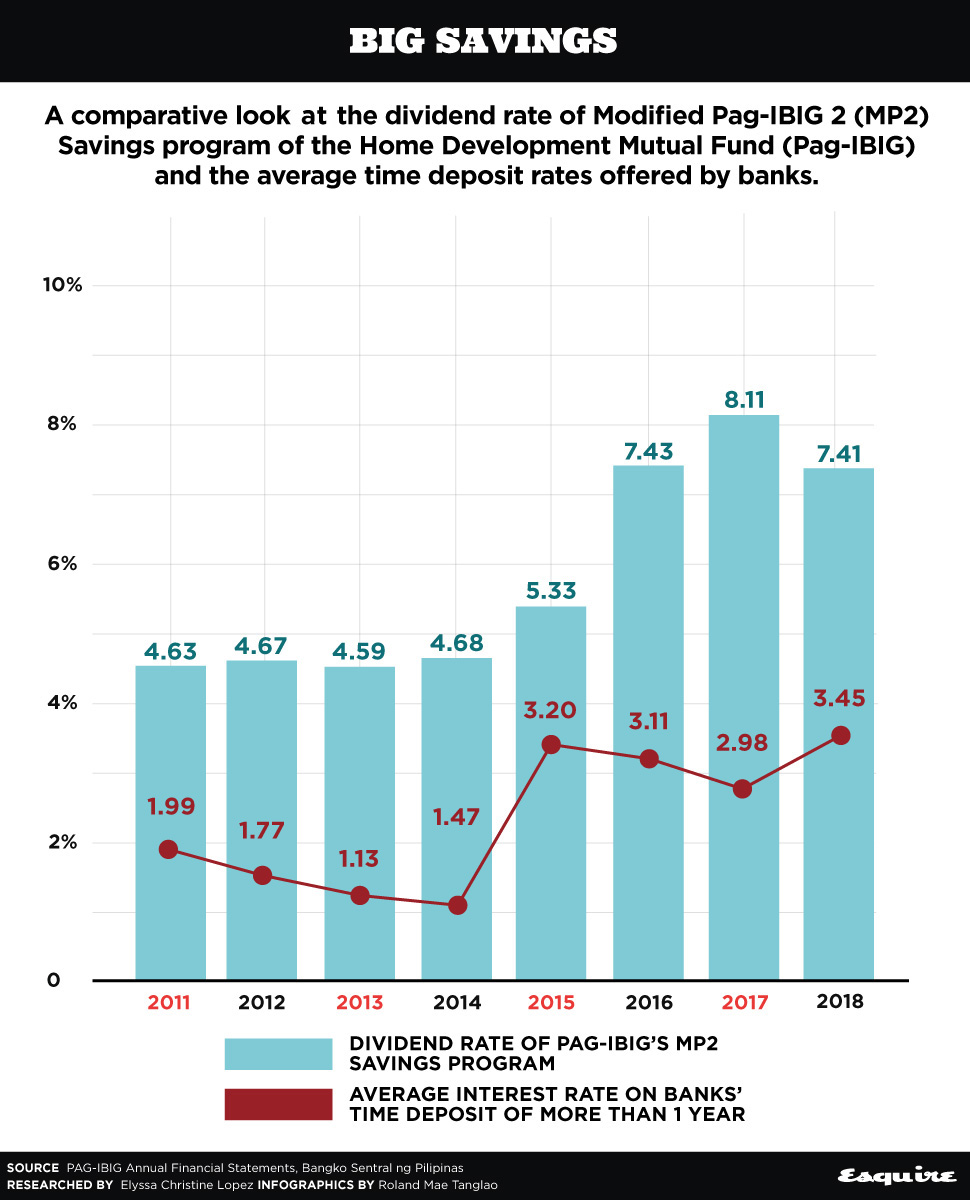

The Pag-IBIG Fund’s Modified Pag-IBIG2 (MP2) savings program, which seeks placements maintained for a five-year period, offers a more competitive dividend rate than most offered by banks and even corporate bonds. As seen in the infographic below, the program has been offering higher dividend rates for the past eight years in contrast to the average interest rates offered by leading commercial banks on time deposits, based on data from the Bangko Sentral ng Pilipinas (BSP).

ADVERTISEMENT – CONTINUE READING BELOW

Launched in 2010, the MP2 only seeks a minimum monthly contribution of Php500 over 60 months or five years, with the promise that members can earn 50 basis points above the fund’s annual dividend rate. The annual dividend rate is based on the financial performance of Pag-IBIG in the preceding year so it varies annually.

In April, the government-run fund set the annual dividend rate of the MP2 Program at 7.41 percent for 2019. While almost one percentage point lower than the previous year, it’s still higher than the average interest rate offered by commercial banks in 2018 on time deposits kept for less than two years at 3.45 percent.

It’s also technically a better investment plan than the seven-year corporate bond offer of SMC Global Power Holdings Corp., the power subsidiary of San Miguel Corporation, which promises a 7.6 percent annual yield. The SMC bond offer not only demands investors to keep their money a bit longer, but it seeks a higher investment amount, too.

ADVERTISEMENT – CONTINUE READING BELOW

Moreover, annual dividend rates offered by Pag-IBIG have been on an upward trend for years now. And with its recent financial performance, closing 2018 with a net income of P33.17 billion, up by 10 percent from the previous year, it’s likely that MP2 Savings members may enjoy above-market interest rates for quite a while.

*****

This story originally appeared on Esquiremag.ph.

* Minor edits have been made by the Entrepreneur.com.ph editors.

Source link

DRIVE STARTUPS We Present Latest Startup News, Tips & Inspiration

DRIVE STARTUPS We Present Latest Startup News, Tips & Inspiration